IRA beneficiary designations specify who should receive your retirement account funds if you are to pass away. But there’s much more to it than that. Despite the importance of naming beneficiaries, it is often at the bottom of the to-do list.

When a Traditional or Roth IRA is opened, it is often the result of a rollover from a company retirement account like a 401k. A rollover is a very common transaction where you transfer funds from a 401k or other qualified retirement plan to an IRA. This process is done without resulting in taxes or penalties that would otherwise be levied on a retirement account distribution.

A rollover transaction is just one of many events happening at that point in time. You’ve left one job and moved on to another. Maybe you are still in the process of finding a new job. Either way, life gets busy and often times, IRA beneficiary designations are either neglected or done in haste. What doesn’t help matters is that discussions about death or considering our mortality can be difficult for some.

Whatever the reason, it is important to give serious consideration to your IRA beneficiary designations. This article will cover some of the basic considerations and provide a solid foundation for making prudent decisions with regard to your IRA. Here’s what you need to know about IRA beneficiary designations.

Primary vs contingent beneficiaries:

When you fill out an IRA beneficiary designation form, there are typically several spots to write in the person’s information. It’s important to pay attention to whether you’re entering primary beneficiary information or contingent. A primary beneficiary is who you want the funds to go to first. Think of the primary beneficiary as being the first in line. The only way the primary beneficiary loses their spot in line is if they pass away.

Consider the following situation. You’re single and you designate your adult sibling as your 100% beneficiary. Your sibling passes away before you and you don’t update your paperwork and you pass away soon after. Or, you are married and designate your spouse as 100% primary beneficiary and you both pass away in a car accident at the same time.

In these scenarios your IRA will then become part of your estate and will be subject to the probate process. Probate is a public process through the court system. A judge will determine who should inherit the proceeds from your IRA. Probate is costly and time consuming. Going through it defeats the purpose of designating beneficiaries in the first place.

This is where the contingent designation comes in. The contingent is second in line after the primary. If the primary beneficiary passes away before the account owner, the contingent beneficiary becomes the primary. Consider this as an added layer of protection to avoid the probate process.

Adding multiple beneficiaries:

What is surprising about IRAs is that they don’t require a beneficiary designation at all. This may vary between financial institutions, but for the most part, it is the IRA owner that decides whether to make designations. As a result, many IRAs are established with no beneficiary designation or left with outdated beneficiaries.

Many financial institutions will allow you to make multiple IRA beneficiary designations. For example, let’s assume you’re single and have four adult siblings. You want to make sure your siblings receive your funds if you were to pass away. You will likely be able to designate all four as primary beneficiaries and even allocate differing percentages to each.

If you’re married, adding multiple primary beneficiaries might be problematic. The reason is that some states require a spouse to be 100% primary (sole beneficiary). If the IRA owner is married and specifies someone other than the spouse, the financial institution will likely require that the spouse sign off and provide their approval.

Naming minors as beneficiaries:

Naming minors as beneficiaries is problematic. A minor is not able to make investment and financial decisions on their own. Courts will often require that a custodian be named to administer the IRA assets on behalf of the minor until they reach age 18.

If you haven’t provided specific instructions via some basic estate planning designating a legal guardian for the minor beneficiary, the courts will pick one for you. And, you might not like their choice.

If you have young children or are considering adding minors as beneficiaries, proceed with caution. Discuss these issues with an estate planning attorney with experience in this area to decide what the best way to accomplish this goal is.

Wills and trusts don’t cover your IRA and other retirement accounts:

Basic estate planning involves setting up a will and trust. They are not the same thing and usually work in conjunction with each other. While IRA beneficiary designations are usually pretty low on the priority list, estate planning is even lower. It is one of those things that we know we need to do but for a variety of reasons, we don’t.

There’s a misconception that estate planning is just for the rich. It isn’t. In addition, the estate planning process forces us to make decisions pertaining to our incapacity or death and many people just shut down. It’s an understandable reaction, but these basic documents need to be in place before something happens, not after.

This process isn’t cheap either so that’s another barrier. The old quote from Benjamin Franklin comes to mind:

“An ounce of prevention is worth a pound of cure.”

For those that have set up their basic estate planning, kudos to you. You invested time and money and dealt with a difficult subject matter. Now after all of this, you find out that your will and trust, doesn’t include your IRA beneficiary designations. That’s right. This all-encompassing process of estate planning doesn’t cover your retirement accounts. When I say this to clients, they look as if they’re in shock. But, it’s not as bad as it sounds.

It just means you can’t neglect your IRA and other retirement account beneficiary designations and assume your will and trust override them. They don’t. If you have an IRA with outdated beneficiaries and your will and trust says something different, the funds go to what is on file at the financial institution. If you’ve updated your will and your trust, you need to go back and update your IRA and other retirement accounts too.

Understanding IRA beneficiary designation agreements

There isn’t a uniform standard that governs how financial institutions handle IRA beneficiary designations. When you designate beneficiaries, you are agreeing to that financial institution’s terms. Be sure to read this agreement. Here’s something to look out for.

I recently reviewed a large financial institution’s terms regarding beneficiary designations. It states:

“I understand that if a Primary Beneficiary predeceases me, the remaining portion will be divided proportionately among any surviving Primary Beneficiaries in the manner provided in the Individual Retirement Plan.”

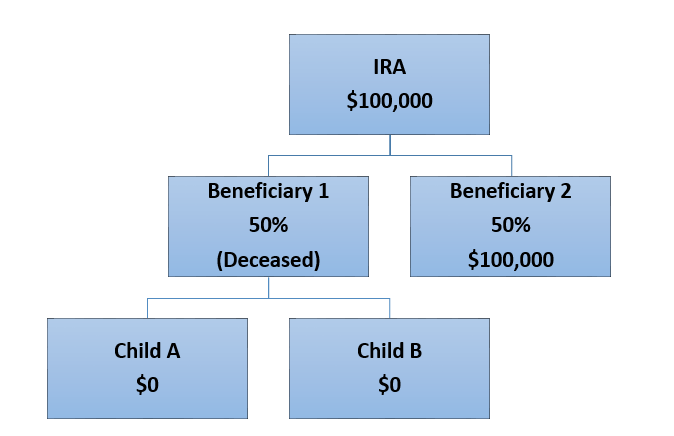

What does this mean? Consider the following scenario. You designate two beneficiaries and both are to share 50/50. One of those beneficiaries passes away leaving behind two children. You don’t update your beneficiary forms with the institution. Later, you pass away. All of your account balance will go to the remaining living beneficiary. That means the heirs of the deceased beneficiary would be left out.

This may not be what the IRA owner intended when the designations were originally made. There are ways to protect against this but how it is done will likely vary depending on which financial institution you’re working with. Some institutions will allow you to make per stirpes designations. This is a Latin legal term to describe the method of dividing a decedent’s estate by family group. In the case of IRA beneficiaries, it is a way to make sure the heirs of a beneficiary aren’t left out.

In the example below, the same scenario applies only with the added per stirpes designation. This allows the heirs (child A and child B) to share in what would have gone to the deceased beneficiary. This designation makes a huge difference in how and to whom the funds are distributed.

IRA beneficiary designations are of major importance and should not be neglected. As our lives change, we need to be diligent in making sure our records are up to date and reflect our current goals and objectives. Failing to do so may result in major problems that could negatively impact relationships with family members. While the subject matter may be difficult to discuss, IRA beneficiary designations should be moved to the top of your financial planning to-do list.

Fantastic information, David – thank you! One question: can I give different designations to multiple beneficiaries? In other words, have one beneficiary per capita and the others per stirpes? I have a widowed in-law that I want to take care of if she’s living, but if she predeceases, I want her share to be split between the other beneficiaries (immediate family) rather than HER heirs. I THINK designating her as per capita and the others as per stirpes should do the trick, but nothing I can find addresses doing it this way.

Thank you and glad you found it helpful. I can’t answer this with certainty. I will say that much of it will depend on investment provider. Not all investment firms have the same policies regarding designation of beneficiaries.

Very good information Dave, thank you. My father recently passed, he has a Roth account with myself, my brother and sister as beneficiaries. My sister and brother predeceased my father. the question is will my sister or brother’s children be intitled to any of the Roth account. I am fairly certain he listed us all as primary beneficiaries and didn’t change it when they passed. We live in North Carolina, not sure if state laws are different. Thank you again.

Hello Tony and thank you for the question. I am sorry to hear of your loss. I can’t give you a definitive answer on this. If you haven’t already, be sure to check with the investment provider. They may have some default language in the beneficiary section that provides guidance for this type of situation. Also, since state laws vary, I suggest reaching out to an estate planning attorney licensed in North Carolina. I’m sorry I can’t provide you a firm answer on this. Please come back and post the outcome in the comments when this gets resolved.

IRA recently sent to unclaimed funds due to neglect by myself not contacting the bank. Huge headache by the way, taxes, 10%early withdraw fee, COVID. Money not in unclaimed funds yet. Will not file taxes until issue is resolved. Potential return is minus 1600 due to having to claim as income on money I have NOT received at this point in time.

Bank did say they tried to contact me by mail. My question is: Can they (bank) send my money to unclaimed funds without contacting primary or contingent beneficiary. If they cannot find me. Would they not presume that I am dead? If presumed dead, I would think the bank would try the beneficiaries route before kicking the money to unclaimed funds.

Any others heard of a situation like this? I’m in a world of headache over this